What you need to know about energy contracts

By John Kiemele, En-Pro Vice President and Sr. Analyst

Everybody knows energy moves the world.

It moves business, cities, people, and entire countries.

Here at home, energy is complicated, and as manufacturers and multi-location businesses that spend a lot of money and time buying energy, try to keep up with the volatility of the markets. And, there is another caution to consider – energy brokers.

The market is ripe with brokers who take advantage of depressed energy markets. Prices may be rock bottom, though they’ll rebound sooner or later. However, many brokers out there are selling contracts that get businesses rates lower than last year, but everything’s lower. And locking in now for prices that beat last year is no strategy.

In order to take advantage of the less than stellar market, energy procurement teams need to know how to structure the right energy supply contracts. But it’s no easy endeavor.

The first step would be to avoid the brokers and agents out there who take commission fees based on your length and terms of contract that often hidden, not to mention rife with other things hidden inside them.

Brokers and agents market 100% fixed-price, long-term contracts for major marketers of energy.

Their fees/commissions are built into the price and are most often excessive.

Because they are paid higher commissions when you lock in for longer periods of time the lack objectivity and have a vested interest to protect their own interests, not yours.

Your energy supply contract will only be as solid as the supplier you choose. So another thing that should be considered is to check the credit rating of the supplier you’re considering.

Ensure your supplier backs up any fixed price arrangements and has a credit rating that ensures their long term viability. Energy markets are volatile and sudden swings in price have led to the collapse of many suppliers in past years (for example: Enron and SEM Canada).

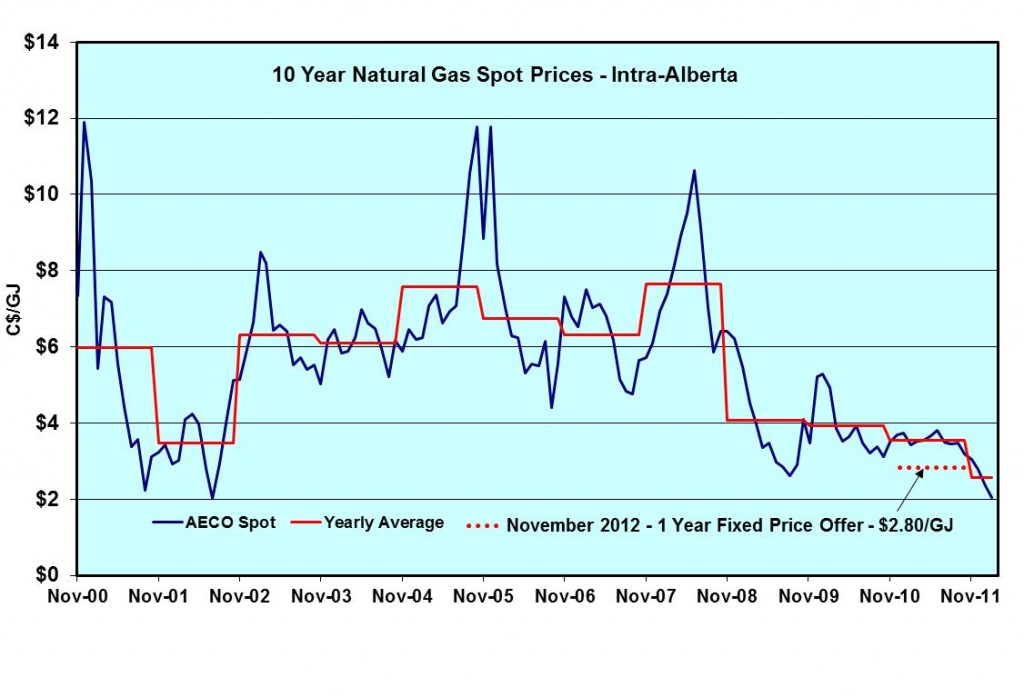

In natural gas purchasing for example, prices should always be equivalent to the daily spot price with the option to convert to fixed-pricing at your discretion. As the following graph shows, natural gas spot prices have spiked and hit rock bottom.

Finally – and certainly not least of all – set your strategy. Know what your budget for energy will be yearly, and make certain you have a reputable and transparent contract. Remember also when floating on spot prices, a strategy is essential, with fixed pricing targets so that rates can be locked in place for various time periods as market conditions allow.

Once your strategy is in place and fixed price targets are set, pricing should be monitored daily to ensure rates are locked in when market conditions allow.

Always look ahead to future periods to ensure you are aware of potential risks and have strategies in place to protect against them.

Energy markets are volatile because their based on speculation. You don’t have time to speculate about your business decisions. You need to make sound decisions based on comprehensive information that will move your business forward.